What is an Employee Stock Ownership Plan (ESOP) and How Does It Work?

ESOP, which stands for Employee Stock Ownership Plan, is a financial arrangement that enables employees to become partial or full owners of the company they work for. Under an ESOP, eligible employees are granted or have the opportunity to purchase shares of the company's stock as a form of compensation or retirement benefit.

The primary objective of an ESOP is to align the interests of employees with those of the company by giving them a stake in its success. This ownership stake can motivate employees to work harder, increase their commitment to the organization, and foster a sense of loyalty and dedication. ESOPs are commonly used as a tool to attract and retain talented employees, as well as to enhance employee engagement and productivity.

ESOPs offer several potential benefits to both employees and employers. For employees, an ESOP provides an opportunity to accumulate wealth over time as the value of the company's stock grows. It also offers a sense of pride and ownership in the organization's achievements. Moreover, ESOPs can serve as a retirement benefit, enabling employees to build a nest egg for their future.

Employers can benefit from ESOPs in multiple ways. Firstly, ESOPs can be utilized as a tax-advantaged way to reward employees, as contributions to the plan are typically tax-deductible. Additionally, ESOPs can assist with succession planning, allowing business owners to gradually transition ownership to employees over time. This can ensure continuity and stability for the company. Furthermore, ESOPs can help companies attract and retain top talent by offering an attractive and competitive benefits package.

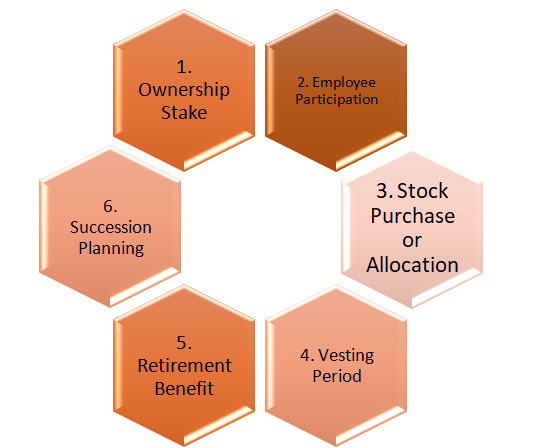

FEATURES OF ESOPs

1. Ownership Stake: ESOPs grant employees an ownership stake in the company. This means that eligible employees become shareholders and have a direct financial interest in the company's success and growth. The ownership stake can be in the form of shares or stock options.

2. Employee Participation: ESOPs typically offer participation to a broad base of employees, although eligibility criteria may vary. Employees may need to meet certain service requirements or work a specified number of hours to become eligible to participate in the ESOP.

3. Stock Purchase or Allocation: ESOPs can allocate or sell company stock to employees through various methods. In some cases, the company may directly allocate shares to employees at no cost. In other instances, employees may have the opportunity to purchase shares at a discounted price, often through payroll deductions or other convenient means.

4. Vesting Period: ESOPs often have a vesting period, which is the length of time an employee must remain with the company before fully owning the allocated or purchased shares. Vesting periods can vary, but a common structure is a gradual vesting schedule over several years, encouraging employee retention.

5. Retirement Benefit: ESOPs can serve as a retirement benefit for employees. As employees accumulate shares in the ESOP, the value of those shares can grow over time. Upon retirement, employees may have the option to sell their shares back to the company or to other eligible employees, providing a source of income in their retirement years.

6. Succession Planning: ESOPs can serve as an effective tool for succession planning, especially for closely-held or family-owned businesses. The ESOP provides a structure for the gradual transfer of ownership to employees over time, ensuring the continuity and stability of the company while potentially providing a smooth transition for the current owners.

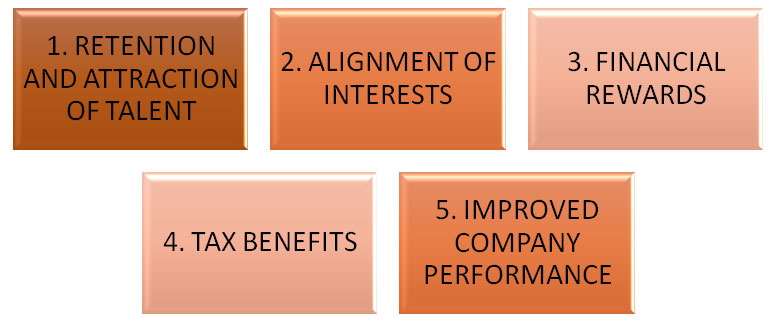

BENEFITS OF ESOPs

1. Retention and Attraction of Talent: ESOPs can be an attractive benefit for attracting and retaining top talent. The opportunity to become an owner of the company can be a powerful incentive for employees to join and remain with the organization, particularly in competitive job markets. ESOPs can also contribute to a positive company culture and foster a sense of loyalty among employees.

2. Alignment of Interests: ESOPs align the interests of employees with those of the company. When employees have a financial stake in the company's success, they are more likely to make decisions that positively impact the organization's performance. This alignment can lead to better teamwork, increased collaboration, and a shared commitment to achieving business objectives.

3. Financial Rewards: As the company's stock value increases, employees who hold ESOP shares can experience financial gains. ESOPs can be a means for employees to accumulate wealth over time, especially if the company performs well and the stock value appreciates. This can be particularly valuable for employees who may not have access to traditional investment opportunities.

4. Tax Benefits: Employers can enjoy various tax advantages by implementing an ESOP. Contributions made by the company to the ESOP are often tax-deductible, reducing the overall tax burden. These tax benefits can free up funds that can be reinvested in the company's growth or used for other strategic initiatives.

5. Improved Company Performance: Research has shown that companies with ESOPs tend to perform better than their counterparts. ESOPs have been associated with increased productivity, higher sales growth, and improved profitability. This can be attributed to the sense of ownership and engagement that ESOPs foster among employees, leading to a more motivated and committed workforce.

Implementation of ESOPs

1. ESOP Plan Document: The ESOP plan document is the core legal document that outlines the terms and conditions of the ESOP. It includes provisions such as eligibility criteria, vesting schedules, stock allocation or purchase methods, and distribution rules. The plan document must comply with applicable laws and regulations governing ESOPs.

2. Trust Agreement: ESOPs typically utilize a trust to hold and manage the shares on behalf of the participants. The trust agreement defines the roles and responsibilities of the trustee, who is responsible for managing the trust assets, voting rights, distributions, and other administrative aspects of the ESOP.

3. Stock Purchase Agreement: If the ESOP involves the purchase of company shares by employees, a stock purchase agreement may be required. This agreement outlines the terms and conditions of the stock purchase, including the purchase price, payment terms, and any additional provisions related to the transaction.

4. Employee Communications: It is essential to provide clear and comprehensive communication to employees about the ESOP. This may include an employee handbook, summary plan description (SPD), or other documents that explain the details of the ESOP, including eligibility, benefits, vesting, and other key provisions. These communications help ensure that employees understand their rights and responsibilities under the ESOP.

5. Board Resolutions: Depending on the company's structure and internal governance, board resolutions may be necessary to authorize the establishment of the ESOP and approve key decisions related to its implementation. These resolutions demonstrate the board's approval and commitment to the ESOP.

6. Appraisal or Valuation Report: ESOPs require an independent appraisal or valuation report to determine the fair market value of the company's shares. This report helps establish the pricing for stock allocations or purchases and ensures compliance with regulatory requirements.

It's important to note that the specific documents required may vary based on the jurisdiction, company structure, and legal requirements. Consulting with legal and financial professionals experienced in ESOPs is essential to ensure compliance and to tailor the documentation to the specific needs and circumstances of the organization.

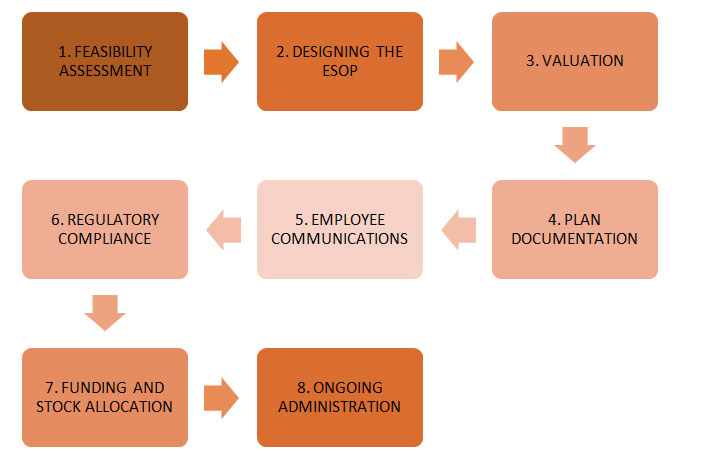

PROCESS OF ESOPs

The process of implementing an ESOP (Employee Stock Ownership Plan) typically involves several steps. While the specific details may vary based on the company's circumstances and jurisdiction, here is a general overview of the ESOP implementation process:

1. Feasibility Assessment: The first step is to conduct a feasibility assessment to determine whether an ESOP is a suitable option for the company. This assessment includes evaluating the company's financial situation, ownership structure, and employee demographics. It also involves assessing the potential benefits and costs associated with implementing an ESOP.

2. Designing the ESOP: Once the decision to proceed with an ESOP is made, the next step is to design the plan. This involves determining the key parameters, such as eligibility criteria, vesting schedule, contribution methods, and valuation methodology. The design should align with the company's goals and comply with applicable legal and regulatory requirements.

3. Valuation: The company's shares need to be valued to determine the initial stock price or establish a fair market value for ongoing transactions. This typically involves engaging an independent appraiser who will assess the value of the company based on various factors, such as financial performance, market conditions, and industry trends.

4. Plan Documentation: The ESOP plan document and trust agreement must be drafted. These documents outline the rules, provisions, and responsibilities related to the ESOP. They include details about share allocation or purchase, vesting, distribution rules, and administrative procedures. Legal counsel or ESOP specialists can assist in preparing these documents.

5. Employee Communications: Clear and comprehensive communication with employees is essential to ensure they understand the ESOP and its benefits. This may involve conducting employee meetings, providing written materials, and offering opportunities for questions and clarifications. Employees should have a thorough understanding of their rights, eligibility, and the impact of the ESOP on their financial future.

6. Regulatory Compliance: ESOPs are subject to various legal and regulatory requirements. This may involve obtaining approvals or filing necessary documents with government agencies, such as the Department of Labor (DOL) and the Internal Revenue Service (IRS). Compliance with reporting, disclosure, and fiduciary responsibilities is crucial to maintain the ESOP's tax-advantaged status.

7. Funding and Stock Allocation: Once the ESOP is established and all necessary approvals are obtained, the company needs to determine the funding mechanism for the ESOP. This can involve contributions of cash or shares to the ESOP trust. The shares are then allocated or sold to eligible employees according to the ESOP's provisions.

8. Ongoing Administration: After the initial implementation, the ESOP requires ongoing administration, which involves tracking employee participation, managing vesting, overseeing distributions, and ensuring compliance with reporting and regulatory requirements. Employers may choose to have an internal team or engage a third-party administrator to handle these responsibilities.

It's important to note that the process of implementing an ESOP can be complex and involve legal, financial, and tax considerations. Consulting with professionals experienced in ESOPs, such as lawyers, accountants, and ESOP specialists, is highly recommended to navigate the process effectively and ensure compliance with applicable regulations.

FAQS

Q.1. What is an ESOP?

Ans: ESOP is an Employee Stock Ownership Plan that grants employees ownership in the company they work for.

Q.2. How does an ESOP work?

Ans: ESOPs allocate or sell company shares to employees, providing them with a financial stake and potential rewards.

Q.3. What are the benefits of an ESOP?

Ans: ESOPs can enhance employee motivation, loyalty, and retirement savings while providing tax advantages for both employees and employers.

Q.4. Who is eligible for an ESOP?

Ans: Eligibility for an ESOP can vary but generally includes employees who meet certain service requirements or work a specified number of hours.

Q.5. How are ESOP shares valued?

Ans: Independent appraisers determine the value of company shares for ESOP purposes based on financial performance, market conditions, and industry trends.

Q.6. Can employees sell their ESOP shares?

Ans: Depending on the ESOP's rules, employees may have the opportunity to sell their ESOP shares back to the company or to other eligible employees.

Q.7. Are ESOP contributions tax-deductible?

Ans: Contributions made by the company to the ESOP are often tax-deductible, reducing the overall tax burden.

Q.8. Can ESOPs be used for succession planning?

Ans: Yes, ESOPs can serve as a tool for gradually transitioning ownership to employees, ensuring business continuity and stability.

Q.9. What is the role of a trustee in an ESOP?

Ans: The trustee is responsible for managing the ESOP's assets and ensuring compliance with fiduciary responsibilities.

Q.10. How do ESOPs benefit companies?

Ans: ESOPs can help attract and retain talented employees, align employee interests with company success, and provide tax advantages for employers.