INTRODUCTION TO LIMITED LIABILITY PARTNERSHIP (LLP)

LLP stands for Limited Liability Partnership. It is a legal business structure that combines the features of both a partnership and a limited liability company (LLC). An LLP offers limited liability protection to its partners while allowing them to participate in the management and operation of the business.

According to the LLP Act 2008, an LLP is a form of business entity where the liability of partners is limited to their agreed contribution in the LLP. It is a separate legal entity distinct from its partners, and it can enter into contracts, sue, and be sued in its own name. The Act provides for the incorporation, governance, and functioning of LLPs in India.

In an LLP, partners have limited liability, which means they are not personally responsible for the debts and liabilities of the partnership. This protection shields partners' personal assets from being used to satisfy business obligations. However, partners are still liable for their own wrongful actions or misconduct.

FEATURES OF THE LIMITED LIABLITY PARTNERSHP

- LIMITED LIABLITY: One of the key features of an LLP is limited liability protection. Partners in an LLP are not personally liable for the debts and liabilities of the partnership. Their liability is limited to the extent of their agreed contribution to the LLP. This means that partners' personal assets are generally protected from being used to satisfy the partnership's obligations.

- SEPARATE LEGAL ENTITY: An LLP is considered a separate legal entity from its partners. It can own assets, enter into contracts, sue, and be sued in its own name. This separation provides the partnership with perpetual existence, unaffected by changes in partners.

- PERPETUAL SUCCESSION: LLPs enjoy perpetual succession, meaning that the existence of the partnership is not affected by the death, retirement, or insolvency of any partner. The LLP can continue its operations as long as it complies with the requirements of the LLP Act or the governing legislation of the jurisdiction.

- FLEXIBLITY IN MANAGEMENT: LLPs offer flexibility in terms of management and decision-making. Partners have the freedom to participate in the management and operation of the LLP, making it different from a traditional limited company where shareholders have limited involvement in day-to-day affairs. LLPs allow partners to take an active role in running the business.

- LIMITED REGULATORY COMPLIANCE: LLPs generally have fewer regulatory compliance requirements compared to companies. The filing and disclosure obligations may vary depending on the jurisdiction, but they are typically less burdensome than those of corporations.

CHECKLIST FOR INCORPORATION OF LIMITED LIABLITY PARTNERSHIP

| SR.NO | PARTICULARS | DOCUMENTS AND DETAILS REQUIRED |

| 1. | OBTAIN DSC |

|

| 2. | NAME RESERVATION |

|

| 3. | FORM FiLLiP |

|

| 4. | APPLY FOR PAN AND TAN |

|

| 5. | PREPARE LLP AGREEMENT |

|

| 6. | FORM 3 (WITHIN 30 DAYS) |

|

| 7. | APPLICATION FOR VARIOUS STATUTORY REGISTRATION |

|

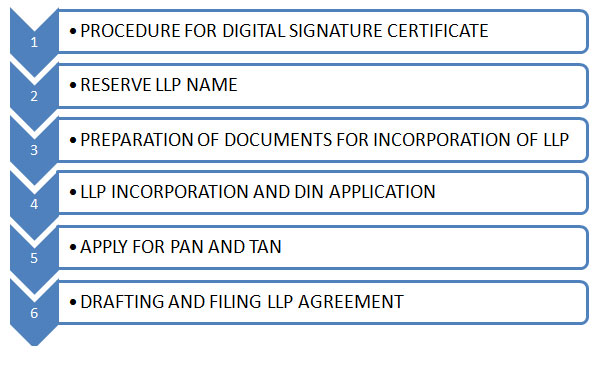

LLP INCORPORATION PROCESS

Stepwise procedure for the incorporation of new LLP is discussed as follows:

STEP 1: PROCURE DIGITAL SIGNATURE CERTIFICATE

Every form or application is filed online with the MCA, which requires to be signed digitally by the applicants and partners of the LLP. Therefore, the DSC with validity of 2 years is procured for the Designated Partners of the Limited Liability Partnership. The DSC is associated with the PAN card of the application. It further requires passport size photograph and address proof.

STEP 2: RESERVE LLP NAME

The new process requires the applicants to file the web form named RUN-LLP (Reserve Unique Name – Limited Liability Partnership). The similar web form – RUN is already deployed to secure company’s name. RUN-LLP has replaced the old form LLP Form 1. The new form has been simplified that requires information related to the desired name, its significance and other basic details.

The application can be made with maximum 2 names in preference order providing their significance. The names must comply with the applicable provisions for name reservation. If none of the names is approved by the MCA, another chance is provided to apply two more names. The government fees for RUN, as per Register Office Fees Rules, shall be Rs 1,000. DSC and DIN are not required for filing of RUN form for reservation of name but account of MCA portal is mandatory. Once the name is allotted for LLP, it is reserved for a period of 90 days from date of approval.

STEP 3: PREPARATION OF DOCUMENTS FOR INCORPORATION OF LLP

After approval of name, LLP applicant is required to prepare the following documents: Proof of office address (Conveyance/Lease Deed/Rent Agreement etc. along with rent receipts) NOC from owner of the property Copy of utility bills (not older than 2 months) Subscription sheet including consent In case, a designated partner does not have a DIN, it is mandatory to attach: Proof of identity and residential address of the subscribers All the DPs should have digital signature Detail of LLP(s) and/or Company(s) in which partner or designated partner is a director/partner Copy of approval in case the proposed name contains any word(s) or expression(s) which requires approval from Central Government.

STEP 4: LLP INCORPORATION AND DIN APPLICATION

The major change in the new process is this step and application. Earlier, the incorporation application was supposed to be filed in LLP form 2, which is now replaced with FiLLiP (Form for incorporation of Limited Liability Partnership). The most significant part is integration of DIN Allotment Application with incorporation application. Below mentioned are the features of the application: DPIN/DIN application for maximum 2 Designated Partners (DPs) can be made under the application. If there are more than 2 DPs who do not hold DIN, they can be added later by following respective filings.

With this form, the application for name reservation can also be made. However, that is kept at the option of the applicants. The applicants can either choose to reserve name through LLP-RUN or under this form.

The application is accompanied with required documents including the subscriber’s sheet and registered office address proof. The e-form will be attested by the partners through PAN based DSC and certified by the practising professional (CA/CS/CWA).

The application will be processed for approval by Central Registration Centre (CRC). If the registrar finds it necessary to call for further documents or information, he may do so by directing for re-submission within 15 days. Another opportunity of re-submission maybe provided after re-examination of application, which again has 15 days period. It is provided that the total period for re-submission of documents shall not exceed 20 days in total.

Upon approval of the application made for LLP registration online, the Certificate of Incorporation (CoI) will be issued in form 16 along with DPIN/DIN allotted to the Designated Partners. CoI will also consist of the Limited Liability Partnership Identification Number (LLPIN). The date of CoI will be the date of LLP incorporation since when it has come into legal existence. LLP is now entitled to commence business in its name.

STEP 5: APPLY FOR PAN AND TAN

Unlike the in case of company, the application for PAN and TAN is required to be made separately for LLP through offline or online mode. The applications are made directly to the Income Tax Department and also processed by it. The applications are made in forms 49A and 49B respectively with Certificate of Incorporation as supporting proof.

STEP 6: DRAFTING AND FILING LLP AGREEMENT

The next step will be to draft LLP Agreement carefully and based on the partners’ requirements. Step-4 and Step-5 both can be processed simultaneously, however, this step would take a little longer to complete than simply making the application.

SOME BASIC ANNUAL COMPLIANCE FOR LIMITED LIABLITY PARTNERSHIP

- ANNUAL RETURN: LLPs are required to file an Annual Return in Form 11 with the Registrar of Companies (ROC) within 60 days from the closure of the financial year. The Annual Return includes details about the LLP's partners, registered office, capital contribution, and other relevant information.

- FINANCIAL STATEMENTS: LLPs need to prepare and file their financial statements with the ROC in the Form 8 and due date for the same is 30th October of each financial year. The financial statements comprise the Statement of Accounts and Solvency (SAS) and the Statement of Income and Expenditure. These statements should be audited by a Chartered Accountant if the LLP meets certain criteria based on turnover and capital contribution.

- INCOME TAX RETURN: LLPs are required to file their income tax returns with the Income Tax Department. The due date for filing income tax returns for LLPs is typically July 31st of the assessment year following the financial year-end. LLPs may also be required to obtain a tax audit if they meet certain turnover thresholds.

- GST RETURNS: If the LLP is registered under the Goods and Services Tax (GST) regime, it needs to file periodic GST returns, such as GSTR-3B and GSTR-1, based on the applicable filing frequency.

- ANNUAL GENERAL MEETING (AGM): LLPs are not required to hold an AGM unless it is specified in the LLP agreement. However, partners may choose to hold a meeting to discuss and approve matters related to the LLP's operations.

- COMPLIANCE CERTIFICATES: LLPs with a turnover exceeding the specified threshold (as per the Companies Act, 2013) are required to obtain a Compliance Certificate from a practicing Company Secretary. This certificate verifies the LLP's compliance with various legal provisions.

FAQ

Q.1.What is the structure of an LLP?

Ans: LLP shall be a body corporate and a legal entity separate from its partners. It will have perpetual succession.

Q.2.What are the restrictions in respect of minimum and maximum number of partners in an LLP?

Ans: A minimum of two partners will be required for formation of an LLP. There will not be any limit to the maximum number of partners.

Q.3. Can an LLP have a corporate entity as a partner?

Ans: Yes, in most jurisdictions, an LLP can have a corporate entity as a partner. This allows for flexibility in the partnership structure and allows companies to participate as partners.

Q.4. Can an LLP be formed with only foreign partners?

Ans: Yes, an LLP in India can be formed with both Indian and foreign partners. However, at least one designated partner must be an Indian resident.

Q.5. Is there a minimum capital requirement for LLP incorporation in India?

Ans: No, there is no minimum capital requirement for incorporating an LLP in India. Partners can contribute any amount of capital as agreed upon.

Q.6.What are the requirements in respect of “Designated Partners”?

Ans: Appointment of at least two “Designated Partners” shall be mandatory for all LLPs. “Designated Partners” shall also be accountable for regulatory and legal compliances, besides their liability as ‘partners.

Q.7.What are the requirements in respect of “Designated Partners”?

Ans: Every LLP shall be required to have at least two Designated Partners who shall be individuals and at least one of the Designated Partner shall be a resident of India. In case of a LLP in which all the partners are bodies corporate or in which one or more partners are individuals and bodies corporate, at least two individuals who are partners of such LLP or nominees of such bodies corporate shall act as designated partners.

Q.8. Can an LLP be converted into a private limited company in India?

Ans: Yes, an LLP can be converted into a private limited company in India. The conversion process involves specific procedures and compliances as per the Companies Act, 2013.

Q.9. Can an existing partnership firm be converted into an LLP in India?

Ans: Yes, an existing partnership firm in India can be converted into an LLP through the process of LLP conversion. This allows the partners to avail the benefits of an LLP structure.

Q.10.Can a listed company be converted to LLP?

Ans: No, only private / unlisted public company can be converted into LLP.