Definition and Objective of Producer Companies

A producer company is a type of corporate entity that is formed to promote the interests of its members, who are primarily agricultural producers. It is a hybrid organization that combines the benefits of a cooperative society and a private limited company. The concept of a producer company was introduced in India through the Companies Act, 1956, and is now governed by the Companies Act, 2013.

In the Companies Act 2013, a Producer Company is defined as a company that is formed and registered under the Companies Act, with the objective of production, harvesting, procurement, grading, pooling, handling, marketing, selling, and export of primary produce of its members or import of goods or services for their benefit.

The primary produce includes the products of farmers or agriculture, horticulture, animal husbandry, fisheries, dairy, beekeeping, or any other primary produce that is specified by the central government.

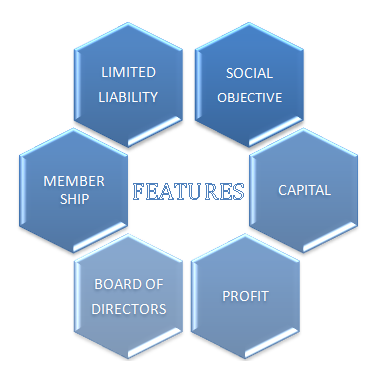

FEATURES OF THE PRODUCER COMPANY

1. Limitedliability: The liability of the members of a producer company is limited to the extent of their shareholdings, protecting their personal assets from any business-related liabilities.

2. Social Objective: Producer companies are expected to undertake activities that promote the social and economic well-being of their members, such as providing training, education, and technical assistance.

3. Capital: The minimum authorized and paid-up share capital for a Producer Company is Rs. 5 lakh’s and Rs. 1 lakh, respectively, which ensures that the members are committed to the company's objectives. The company can raise additional capital by issuing shares to its members, subject to the provisions of the Companies Act.

4. Profit: The profits earned by a producer company are distributed among its members in proportion to their transactions with the company, rather than based on the number of shares held.

5. Board of Directors: A producer company is managed by a Board of Directors elected by the members. The directors are accountable to the members and make decisions on behalf of the company.

6. Membership: The members of a producer company must be primary producers, such as farmers, artisans, dairy farmers, fishermen, etc. They become shareholders and have a say in the decision-making process. The minimum requirement is for 10 or more members.

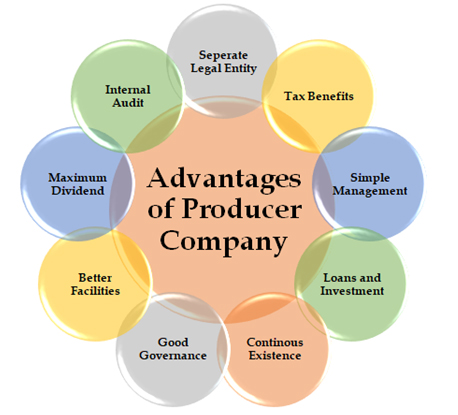

BENEFITS OF THE PRODUCER COMPANY

1. Separate Legal Entity: The advantages and functions of a Producer Company stem from the fact that it is an organization or a legal body created under the Companies Act. It is considered as a separate Legal Entity so neither the owners nor the directors are accountable to the lenders of the Company.

2. SimpleManagement: They can effectively change the Board of Management of the producer organization by submitting basic business structures with the Registrar of Companies. The Board of Management governs and manages the functions of a Producer Company.

3. Good Governance: A producer company is managed by a board of directors who are elected or appointed by the members. The board consists of a minimum of five directors, and they play a key role in decision-making, policy formulation, and overall management of the company. The board is responsible for setting strategic direction, monitoring performance, and ensuring compliance with applicable laws and regulations.

4. Tax Benefit: Companies with annual revenue of more than Rs. 100 crore are eligible for a 100% deduction if they are classified as farmer-producer companies, and those who make a profit from such operations are exempt from paying taxes. As farmers are the main pillars of the national economy and the driving force behind its expansion, the Government of India has increased the benefits of Producer Companies to a 100% deduction for farmers.

5. Loanand Investment: The government is providing financial support to these members of the producer businesses because they are the original producers and require funding from time to time. As a result, the government has established the NABARD bank to help producers and farmers. To address the demands of the producer companies, the bank aims to provide loans to farmers for terms which do not exceed six months.

6. Continuous Existence: The “unending succession” of a producer company can continue indefinitely until it is legally dissolved. A producer organization is unaffected by the takeoffs because it is a separate legal entity.

7. Better Facilities: A producer organization offers the primary farmers a wide platform to get better facilities. These employees of the Company are able to easily access government programs like MNREGA, Pension, Loan, PDS, and Scholarship.

8. Maximum Dividend: In India, the maximum dividend advantage for a producer company is defined by the Companies Act, 2013. The act specifies that a producer company can declare a dividend to its members up to a maximum of 15% of its paid-up share capital

9. Internal Audit: Internal audits of producer companies help identify and mitigate risks, strengthening internal controls. They ensure compliance with laws, regulations, and industry standards, minimizing legal and reputational risks. Internal audits improve process efficiency, reduce costs, and enhance productivity. They detect and prevent fraud, promote management accountability, and drive continuous improvement.

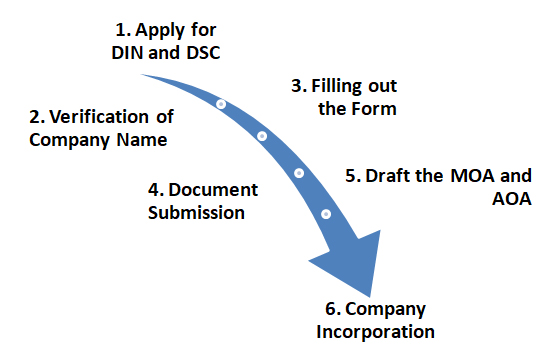

BASIC PROCESS FOR INCORPORATING THE PRODUCER COMPANY

SOME BASIC COMPLIACE FOR A PRODUCER COMPANY

1. Registration: A producer company must be registered under the Companies Act or relevant legislation in the respective jurisdiction. The registration process typically involves filing necessary documents, such as the company's memorandum and articles of association, with the Registrar of Companies.

2. Minimum Number of Members: Producer companies usually require a minimum number of members to be registered. The specific requirement may vary depending on the jurisdiction.

3. Board of Directors: A producer company should have a board of directors responsible for managing the company's affairs. The board must comply with the composition requirements, such as the minimum and maximum number of directors, as prescribed by the applicable laws.

4. Annual General Meeting (AGM): Producer companies are typically required to hold an AGM within a certain timeframe after the end of each financial year. During the AGM, matters like approval of financial statements, appointment or reappointment of directors, and dividend declarations may be discussed.

5. Financial Statements: Producer companies must prepare and file financial statements, including balance sheets, profit and loss statements, and cash flow statements, as per the prescribed format and within the specified timeframe. These statements provide a comprehensive view of the company's financial position and performance.

6. Audit Requirements: Producer companies may be required to undergo an annual audit by a qualified auditor or a firm of auditors. The audit ensures compliance with accounting standards and provides an independent opinion on the company's financial statements.

7. Statutory Records: Maintaining statutory registers and records is crucial for compliance. These may include registers of members, directors, contracts, investments, loans, and charges. The company must update and maintain these records in accordance with the applicable laws.

8. Regulatory Filings: Producer companies may need to file various returns and forms with the regulatory authorities, such as the Registrar of Companies. These filings may include annual returns, change of directors or registered office address, and other significant events as required.

9. Tax Compliance: Producer companies must comply with tax laws and regulations applicable in their jurisdiction. This includes filing tax returns, payment of taxes (such as income tax, goods and services tax, or value-added tax), and fulfilling other tax-related obligations.

10. Compliance with Other Laws: In addition to corporate and tax laws, producer companies must adhere to other relevant laws and regulations applicable to their specific industry or sector. For example, agricultural producer companies may need to comply with specific agricultural laws or regulations governing crop production, storage, or marketing.

DOCUMENTS REQUIRED FOR PRODUCER COMPANY REGISTRATION

- Passport size photographs of the members.

- Copy of PAN Card of the members.

- Copy of Aadhar Card or Voter ID.

- Bank statement (not older than two months)

- Proof of registered place of business like utility bill.

- In the event of a property on rent or lease, a scanned copy of the rental agreement and a NOC from the owner are required

- A copy of the property papers in the case of owned property etc.

FAQS

Q.1.Who can become the member of a Producer Company?

Ans: A Person who is a producer and a producer institution (whether incorporated or not) can be admitted as member of producer company.

Q.2.What is the minimum requirement for no of member?

Ans.Producer Company can be formed by minimum ten or more individuals or two or more producer institution or their combination can also constitute Producer Company.

Q.3 is there any restriction on the maximum no of member for Producer Company?

Ans. The Producer Company can be formed without on restriction on maximum no of members.

Q.4.What is the provision for no of directors in Producer Company?

Ans. Every producer company shall have at least five and not more than fifteen directors.

Q.5.is there any tax benefits available to a producer company?

Ans. Yes, the Income Tax Act 1991 Specifically exempt tax on agriculture income under section 10(1). However, the exemptions for such income sometimes vary depending upon the kind of agriculture activity carried on.

Q.6. Whether appointment of chief executive is mandatory?

Ans. Yes, as per section 581W of the Companies Act, 1956 every producer company shall have a full time chief executive.

Q.7.What is the minimum capital requirement for Producer Company?

Ans. The company At least required Rs 500000 as capital to form a producer company.

Q.8.How much time is consumed to incorporate a producer company?

Ans. It may consume around 35 to 40 working day on average in the process of incorporating the producer company.

Q.9. is producer company need to appoint a company secretary?

Ans. If an average annual turnover exceeds Rs 5 crore in each consecutive 3 financial years than every producer company need to appoint the whole time company secretary.

Q.10.What is the object of Producer Company?

Ans. The producer company can be established for the objects specified in section 581B of the companies Act 1956.

For any consultancy in the incorporation of Public company ||

Contact 7840071184/ 8505999955/ info@ngandassociates.com