Professional Tax Registration

Professional Tax is a tax levied by state governments in India on individuals engaged in certain professions, trades, or employment. It is a state-specific tax, and each state in India has its own regulations regarding the imposition and collection of professional tax. The tax collected is utilized for the development of the respective state.

Professional tax is applicable to individuals who earn an income through employment, practicing a profession, or carrying on a trade or vocation. It is mandatory for eligible professionals and employees to register for and pay this tax.

Who is Liable to Pay Professional Tax?

The liability to pay professional tax generally falls on individuals falling under the following categories:

1. Salaried Employees: Individuals working in private or government jobs, receiving a salary or wage, are liable to pay professional tax.

2. Professionals and Practitioners: Individuals, who are engaged in various professions like doctors, lawyers, architects, engineers, chartered accountants, etc., are subject to professional tax.

3. Traders and Business Owners: Business owners, traders, and self-employed individuals are also liable to pay professional tax.

FEATURES OF PROFESSIONAL TAX REGISTRATION

1. State-Specific Taxation: Professional Tax is a state-specific tax, and the rules and rates vary from one state to another. Each state in India has its own Professional Tax Act and regulations governing the registration and payment process.

2. Mandatory for Eligible Individuals: Professional Tax registration is mandatory for individuals falling under the purview of the respective state's Professional Tax Act. This includes salaried employees, professionals, practitioners, and business owners earning an income from specified professions and trades.

3. Registration Certificate: Once the registration process is completed and the application is approved, the tax department issues a Professional Tax Registration Certificate. This certificate serves as proof of registration and is essential for compliance with the tax laws.

4. Scheduled Tax Payments: Registered individuals are required to make regular tax payments as per the schedule specified by the state government. The frequency of tax payments and the amount payable depend on factors such as income, profession, and other relevant criteria.

5. Audit and Scrutiny: Tax authorities have the power to conduct audits and scrutiny of records to ensure proper compliance with Professional Tax laws. Taxpayers should maintain accurate records and documentation to facilitate the process if required.

6. Penalty for Late Payment: Failure to pay professional tax within the prescribed due date may attract penalties or interest, as specified by the state government.

7. Enforcement and Penalties: State tax authorities enforce compliance with Professional Tax regulations. Non-compliance, such as failure to register or pay the tax on time, may result in penalties or fines as per the state's laws.

8. Online Registration and Payment: Many states provide online facilities for Professional Tax registration and payment, making the process convenient and accessible for taxpayers. This reduces paperwork and improves efficiency.

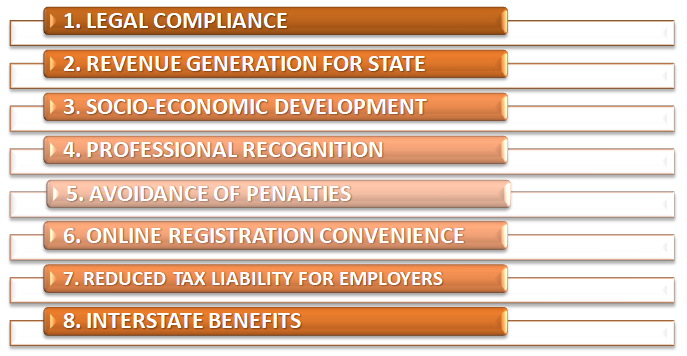

BENEFITS OF PROFSSIONAL TAX REGISTRATION

1. Legal Compliance: Registering for Professional Tax ensures that individuals are compliant with the state's tax laws and regulations. It helps avoid legal issues, penalties, and other consequences that may arise due to non-compliance.

2. Revenue Generation for State: Professional Tax is a significant source of revenue for state governments. The funds collected from this tax are utilized for various developmental projects, infrastructure improvements, and public welfare initiatives within the state.

3. Socio-Economic Development: The revenue generated from Professional Tax plays a vital role in the socio-economic development of the state. It supports education, healthcare, transportation, and other public services that benefit the citizens.

4.Professional Recognition: Holding a Professional Tax Registration Certificate enhances an individual's professional reputation and credibility. It serves as proof that they are registered and compliant with the tax laws.

5.Avoidance of Penalties: Timely registration and payment of Professional Tax prevent individuals from incurring penalties or interest for late payment or non-payment.

6.Online Registration Convenience: Many states provide online registration facilities, making it easier for taxpayers to apply for Professional Tax registration and make tax payments from the comfort of their homes or workplaces.

7. Reduced Tax Liability for Employers: Employers are responsible for deducting and remitting Professional Tax on behalf of their employees. Proper registration ensures that employers fulfill their legal obligations, and it reduces the chances of any liability falling on the employer.

8. Interstate Benefits: For individuals who work in multiple states, having Professional Tax registration in one state may provide certain benefits, such as avoiding double taxation or availing reciprocity provisions.

LIST OF DOCUMENTS REQUIRED FOR PROFESSIONAL TAX REGISTRATION

The specific documents required for Professional Tax Registration may vary slightly from one state to another in India. However, the following are some of the common documents that are typically required for the registration process:

1. Identity Proof: Any one of the following identity proof documents is usually required:

- Aadhar Card

- Passport

- Voter ID Card

- PAN Card

2. Address Proof: Any one of the following address proof documents is generally required:

- Aadhar Card

- Passport

- Voter ID Card

- Utility bills (electricity, water, gas) with the applicant's name and address

3. Proof of Profession: Depending on the nature of the profession, the following documents may be required:

- Appointment letter or employment contract for salaried employees.

- Certificate of practice or registration from the relevant professional body for professionals like doctors, lawyers, chartered accountants, etc.

- Business registration documents for business owners and traders.

4. Educational Qualification: Some states may require documents to verify the educational qualifications of the applicant.

5. Passport-sized Photographs: Recent passport-sized photographs of the applicant are generally required.

6. PAN Card: Permanent Account Number (PAN) card is often mandatory for Professional Tax Registration.

7. Bank Account Details: Bank account details, including a canceled cheque or bank statement, may be needed for the purpose of tax payment and refund, if applicable.

8. Employee Details (for Employers): If the applicant is an employer, details of the employees, such as their names, designations, and salaries, may be required for the registration process.

NOTE: Additional Documents may require based on the state specific registration.

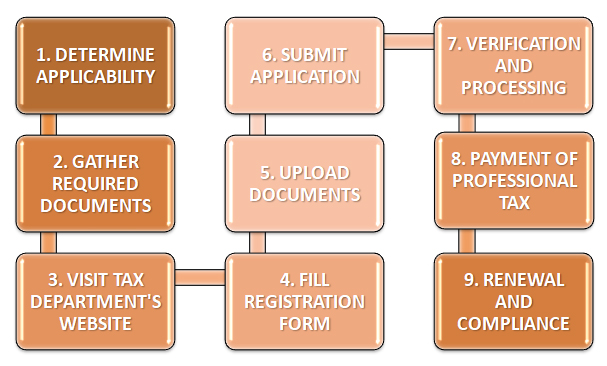

PROCESS FOR PROFESSIONAL TAX REGITRATION

The process for Professional Tax Registration may slightly vary from state to state in India, but the following steps provide a general outline of the registration process:

1. Determine Applicability: First, determine whether you are liable to pay Professional Tax based on your profession, employment, or trade. Different states have different thresholds and criteria for applicability.

2. Gather Required Documents: Collect all the necessary documents required for the registration process, such as identity proof, address proof, proof of profession, educational qualifications, PAN card, bank account details, and passport-sized photographs.

3. Visit Tax Department's Website: Check the official website of the concerned state's tax department for information related to Professional Tax Registration. Many states provide online registration facilities, making the process more convenient.

4. Fill Registration Form: If online registration is available, fill out the Professional Tax Registration form with accurate information. Provide all the necessary details as required in the form.

5. Upload Documents: Attach scanned copies of the required documents, such as identity proof, address proof, and other relevant certificates, as specified by the state's tax department.

6. Submit Application: Once the form is filled and documents are uploaded, submit the registration application through the online portal, if available. If offline registration is required, visit the local tax office and submit the application along with the physical copies of the documents.

7. Verification and Processing: The tax department will verify the provided information and documents. This may involve checking the authenticity of the details provided, verification of the applicant's identity and profession, and other necessary checks.

8. Payment of Professional Tax: After successful verification and processing, the tax department will issue a Professional Tax Registration Certificate. The certificate will contain details such as the taxpayer's name, registration number, and tax amount payable. Pay the professional tax as per the schedule specified by the state government.

9. Renewal and Compliance: Professional Tax Registration is usually valid for a specific period (e.g., one year). Ensure timely renewal of the registration to stay compliant with the tax laws. Additionally, adhere to the tax payment schedule and comply with any other regulations issued by the state's tax department.

FAQS

Q.1. What is Professional Tax?

Ans: Professional Tax is a state-specific tax levied on individuals engaged in professions, trades, or employment.

Q.2. Who is liable to pay Professional Tax?

Ans: Salaried employees, professionals, and business owners are typically liable to pay Professional Tax.

Q.3. Why is Professional Tax important?

Ans: It contributes to state revenue and supports socio-economic development and public services.

Q.4. How often should Professional Tax be paid?

Ans: The frequency of tax payment varies by state; it can be monthly, quarterly, or annually.

Q.5. Is Professional Tax different in each state?

Ans: Yes, each state in India has its own Professional Tax Act and regulations.

Q.6. Can I get exemptions from Professional Tax?

Ans: Some states offer exemptions based on income, age, or other criteria.

Q.7. How can I register for Professional Tax?

Ans: Register online or visit the local tax office with required documents for registration.

Q.8. What documents are needed for registration?

Ans: Identity proof, address proof, proof of profession, PAN card, bank account details, and photographs are typically required.

Q.9. Can employers register employees for Professional Tax?

Ans: Yes, employers are responsible for deducting and remitting Professional Tax on behalf of employees.

Q.10. What happens if I don't pay Professional Tax?

Ans: Non-payment or late payment may lead to penalties and legal consequences.