Introduction to Partnership Firms

A partnership firm is a type of business organization formed by two or more individuals who come together to carry out a business venture with the aim of making profits. Partnerships are based on mutual understanding, trust, and cooperation between the partners. They are often preferred for small and medium-sized enterprises, professional practices, and businesses that require close collaboration and shared decision-making.

In a partnership firm, the partners pool their financial resources, skills, and expertise to run the business. They share the responsibilities, risks, and rewards of the business based on the terms agreed upon in a partnership agreement. This agreement outlines the rights and obligations of each partner, including the division of profits and losses, capital contributions, decision-making authority, and procedures for dispute resolution.

The Indian Partnership Act, 1932, defines a partnership firm as the relation between two or more persons who have agreed to share the profits of a business carried on by all or any of them acting for all. Unlike a company, a partnership firm does not have a separate legal entity. The partners are individually and collectively liable for the debts, obligations, and liabilities of the firm. This means that the personal assets of the partners can be used to settle the firm's debts if it is unable to meet them.

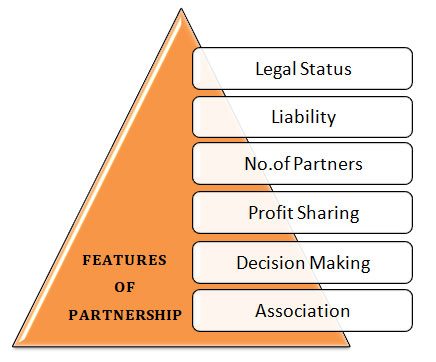

FEATURES OF THE PARTNERSHP FIRM

1. Legal Status: A partnership firm does not have a separate legal identity distinct from its partners. It is not considered a separate legal entity, unlike a company. The partners are individually and collectively liable for the firm's debts, obligations, and liabilities.

2. Liability: Partners in a partnership firm have unlimited liability, which means they are personally liable for the debts and liabilities of the firm. If the partnership firm is unable to meet its obligations, the personal assets of the partners can be used to settle the debts.

3. No.of Partners: A partnership firm can be formed with a minimum of two partners, and the maximum number of partners depends on the laws and regulations of the specific jurisdiction. In India, the maximum number of partners in a partnership firm is generally limited to 20, except for certain professions where higher limits are allowed.

4. Profit Sharing: The partnership agreement specifies the profit-sharing ratios among the partners. The profits generated by the firm are distributed among the partners according to these ratios. However, partners may agree to different profit-sharing arrangements based on their capital contributions, efforts, or other factors.

5. Decision Making: The partnership agreement defines the decision-making process within the firm. Partners may have equal decision-making authority, or specific partners may be entrusted with certain decision-making powers. Unanimous consent or majority voting provisions can also be outlined in the agreement.

6. Association of Person: A partnership firm involves a voluntary association of two or more individuals who come together with a common objective of carrying out a business venture.

BENEFITS OF PARTNERSHIP FIRM

1. Easy to Form: Partnership firms are relatively easy and cost-effective to form compared to other business structures, such as companies. The process typically involves drafting a partnership agreement that outlines the terms and conditions of the partnership, including profit-sharing ratios, capital contributions, and decision-making procedures.

2. Shared Financial Resource: Partnerships allow for the pooling of financial resources from multiple partners. This shared capital can provide a stronger financial base for the business and enable partners to invest more in growth opportunities, acquisitions, or other strategic initiatives.

3. Better Decision: Partnership firms benefit from the collective wisdom and diverse perspectives of multiple partners. Each partner brings their unique knowledge, skills, and experience to the table, which can lead to more comprehensive and well-informed decision-making. Partners can contribute different viewpoints, challenge assumptions, and provide valuable insights that enhance the overall quality of decisions.

4. Flexibility in operation: Partnership firms offer flexibility in structuring their management. Partners can define their roles, responsibilities, and areas of expertise based on their individual strengths and interests. This flexibility enables partners to focus on specific aspects of the business where they excel, leading to more efficient and effective operation of the firm.

5. Benefit of Specialization: n a partnership firm, partners bring different skills, expertise, and perspectives to the table. This diversity can be leveraged to effectively manage various aspects of the business, such as operations, finance, marketing, and human resources. It allows for a division of responsibilities based on individual strengths, leading to a more efficient and balanced management approach

6. Taxation Benefits: Partnership firms in many jurisdictions, including India, are not taxed at the entity level. Instead, profits and losses are passed through to the partners, who are individually taxed on their share of the partnership's income. This can provide certain tax advantages, such as the ability to offset personal losses against partnership profits or take advantage of lower tax brackets for individual partners.

DIFFERENCE BETWEEN PARTNERSHIP AND LIMITED LIABILITY PARTNERSHIP

| SR.NO | PARTICULARS | PARTNERSHIP FIRM | LIMITED LIABILITY PARTNERSHIP |

|---|---|---|---|

| 1. | LIABILITY | In a general partnership, the partners have unlimited personal liability for the debts and obligations of the business. This means that if the partnership cannot cover its liabilities, the partners' personal assets may be at risk | In an LLP, the partners have limited liability, which means their personal assets are generally protected from the partnership's debts and obligations. However, partners may still be personally liable for their own wrongful acts or negligence. |

| 2. | LEGAL STATUS | A general partnership, on the other hand, does not have a separate legal identity apart from the individual partners. The partners collectively form the partnership, and they act on its behalf. | An LLP is a separate legal entity from its partners. It has its own legal status, allowing it to enter into contracts, sue, and be sued in its own name. |

| 3. | FORMATION AND REGISTRATIO | In contrast, a general partnership can be formed simply through an oral or written agreement between the partners, without the need for formal registration. | The process of forming an LLP involves registration with the appropriate regulatory authority, such as the government agency responsible for business registrations. This typically requires filing specific documents, such as a partnership agreement, with the relevant authority. |

| 4. | MANAGEMENT AND DECISION-MAKING | In a general partnership, each partner typically has an equal say in the management and decision-making process, unless otherwise specified in the partnership agreement. | In an LLP, partners can agree on the division of management responsibilities and decision-making authority. This flexibility allows for a more customized management structure. |

| 5. | CONTINUITY AND SUCCESSION: | A general partnership is dissolved if one of the partners withdraws or dies, unless otherwise specified in the partnership agreement. | An LLP, on the other hand, can continue its existence irrespective of changes in the partnership. It offers more continuity and can be transferred to new partners through share transfers or admission of new partners. |

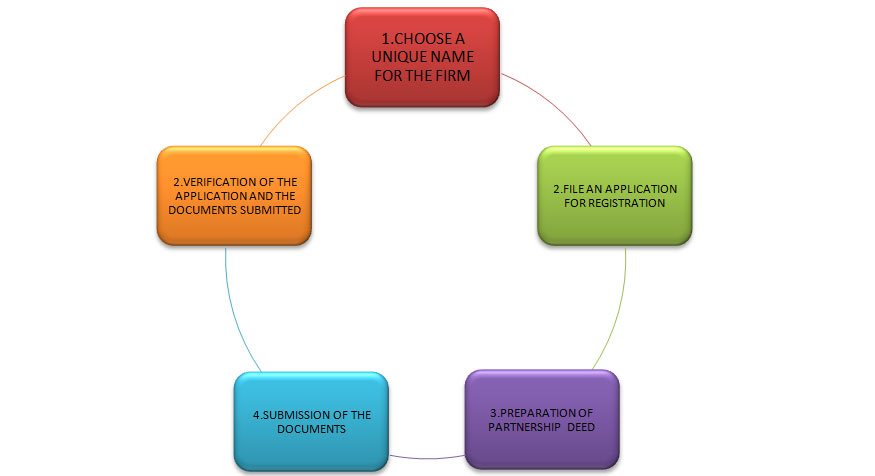

BASIC PROCESS FOR REGISTRATION OF PARTERSHIP

KEY DOCUMENTS REQUIRED FOR INCORPORATING THE PARTNERSHIP FIRM IN INDIA

The documents required to be furnished before the ROFs of the partnership firm includes the following:

- Application form, i.e. Form 1, duly signed by the serving partners.

- A true copy of Partnership Deed enclosing the seal and signature of the concerned authority.

- Specimen of an affidavit authenticating all the information cited in the partnership deed & documents are legitimate.

- Permanent Account Number, i.e. PAN & resident proof of the partners.

- Proof the business place, i.e. lease agreement or rent agreement.

SOME BASIC ANNUAL COMPLIANCE FOR PARTNERSHIP FIRM

1. Income Tax Filing: Partnership firms are generally required to file an income tax return annually. The firm's profits and losses are passed through to the individual partners, who report their share of income on their personal tax returns.

2. Audit Requirements: Depending on the turnover or annual revenue of the partnership firm, it may be required to undergo a statutory audit. The audit ensures the accuracy and reliability of the financial statements.

3. Annual Financial Statements: Partnership firms need to prepare annual financial statements, including a balance sheet, profit and loss statement, and cash flow statement. These statements provide a snapshot of the firm's financial position and performance.

4. Renewal of Registrations and Licenses: Partnership firms must renew any applicable registrations or licenses, such as business registration, GST (Goods and Services Tax) registration, professional licenses, or other permits, as required by the local authorities.

5. Partnership Agreement Review: It is advisable to review the partnership agreement periodically to ensure it remains relevant and reflects any changes in the firm's structure, partners, profit-sharing ratios, or other terms and conditions.

6. Compliance with Labor Laws: Partnership firms need to comply with labor laws and regulations applicable to the jurisdiction. This includes adhering to minimum wage requirements, employment contracts, employee benefits, and any other labor-related obligations.

7. Compliance with Regulatory Filings: Depending on the nature of the partnership firm's business, there may be specific regulatory filings required. For example, if the firm operates in a regulated industry such as finance, healthcare, or transportation, it may have to file reports or disclosures with the relevant regulatory bodies.

8. Annual General Meeting (AGM): While a partnership firm may not be required to hold an AGM in the same way as a company, it is still beneficial to hold regular meetings among the partners to discuss the firm's performance, strategic decisions, and any other relevant matters.

FAQ

Q.1. What is a partnership firm?

Ans:A partnership firm is a form of business organization where two or more individuals (partners) come together to carry out a business venture. They contribute capital, share profits and losses, and jointly manage the business.

Q.2. How many partners are required to form a partnership firm?

Ans: In most jurisdictions, a minimum of two partners is required to form a partnership firm. However, some countries may have specific laws or regulations that dictate the minimum number of partners.

Q.3. Is a written partnership agreement necessary?

Ans: While a partnership agreement is not legally required in all jurisdictions, it is highly recommended to have a written partnership agreement. It helps outline the rights, responsibilities, profit-sharing ratios, decision-making process, and other important aspects of the partnership. It helps avoid conflicts and provides clarity in case of disputes.

Q.4. Are partners personally liable for the firm's debts?

Ans: In a general partnership, partners have unlimited personal liability for the debts and obligations of the firm. This means that if the partnership's assets are insufficient to cover the debts, creditors can go after the partners' personal assets to satisfy the obligations. However, in a limited liability partnership (LLP), partners have limited liability, as explained earlier.

Q.5. How are profits and losses shared in a partnership firm?

Ans: The distribution of profits and losses in a partnership firm is typically determined by the partnership agreement. Partners can agree on a specific profit-sharing ratio, which may be based on the capital contributed, effort, or any other mutually agreed criteria.

Q.6. Can a partnership firm own property or enter into contracts?

Ans: Yes, a partnership firm can own property, enter into contracts, and undertake legal obligations in its own name. However, the extent of the firm's authority and decision-making power is usually defined in the partnership agreement.

Q.7.Can a partnership firm be dissolved or terminated?

Ans: Yes, a partnership firm can be dissolved or terminated by mutual agreement between the partners, expiration of a specified period, completion of the business objective, death or bankruptcy of a partner, or other circumstances outlined in the partnership agreement or relevant laws.

Q.8.How are taxes handled in a partnership firm?

Ans: Partnership firms are typically taxed as pass-through entities, where the profits and losses of the firm are passed on to the individual partners, who then report them on their personal tax returns. The partnership itself does not pay income tax.

Q.9.Can a partner transfer their ownership or leave the partnership?

Ans: The transfer of ownership or withdrawal of a partner is subject to the terms outlined in the partnership agreement. It may require the consent of other partners and formal procedures. The partnership agreement should specify the conditions and procedures for such cases.

Q.10.Can a partnership firm be converted into an LLP or a company?

Ans: In many jurisdictions, there are provisions for converting a partnership firm into an LLP or a company. The specific requirements, procedures, and legal implications may vary based on the local laws and regulations.

For any consultancy in the Formation and compliances of partnership firm ||

Contact 7840071184/ 8505999955/ info@ngandassociates.com