What is a Right Issue?

A right issue, also known as a rights offering, refers to the process through which a company offers its existing shareholders the right to purchase additional shares of the company's stock. This offering is made at a predetermined price and within a specific time period, allowing shareholders to maintain or increase their ownership stake in the company. The term "right" in the context of a right issue denotes the privilege or entitlement given to shareholders to buy additional shares in proportion to their existing holdings. The purpose of a right issue is to raise capital for the company without involving external investors or incurring additional debt. By offering discounted shares to current shareholders, companies can tap into their loyal investor base and generate funds for various purposes, such as financing expansion plans, acquisitions, or research and development activities. Right issues allow companies to maintain shareholder control and avoid dilution while providing existing shareholders with an opportunity to participate in the company's growth and potentially increase their investment value.

FEATURES OF RIGHT ISSUE

1. Increases Company’s Subscribed or Paid-up Capital: By issuing additional shares through a right issue, the company raises funds from existing shareholders. Shareholders who exercise their rights to purchase additional shares contribute new capital to the company. This infusion of capital increases the overall subscribed or paid-up capital of the company.

2. Assists in Overcoming Financial Crises : Financial crises often arise due to a lack of liquidity or insufficient capital. In such situations, a right issue allows companies to inject fresh capital into their operations. By offering additional shares to existing shareholders, the company can raise funds quickly and efficiently. This influx of capital can provide the necessary liquidity to address immediate financial challenges and stabilize the company's operations.

3. Gives Preferential Treatment to Existing Shareholders : Right issues grant existing shareholders the first opportunity to purchase additional shares before they are offered to external investors. This priority access ensures that existing shareholders have a privileged position in acquiring new shares and increasing their ownership stake in the company.

4. A Company Offers Shares to its Shareholders in Proportion to their Shareholdings : Right issues are offered to existing shareholders in proportion to their existing holdings. This means that shareholders have the right to purchase additional shares based on their ownership percentage in the company. This ensures that existing shareholders maintain their relative ownership stakes and have an opportunity to participate in the offering.

5. Provide Right to Trade to Existing Shareholders : In a right issue, the company issues tradable rights to existing shareholders. These rights represent the privilege to purchase additional shares at a specified price within a predetermined time period. Existing shareholders have the option to trade these rights in the market.

6. Provide Existing Shareholder a Right to Decline the Offer of Right Issue : Right issues offer existing shareholders the option to participate or decline the offer. Shareholders have the flexibility to choose whether or not they want to exercise their rights and purchase additional shares at the specified price.

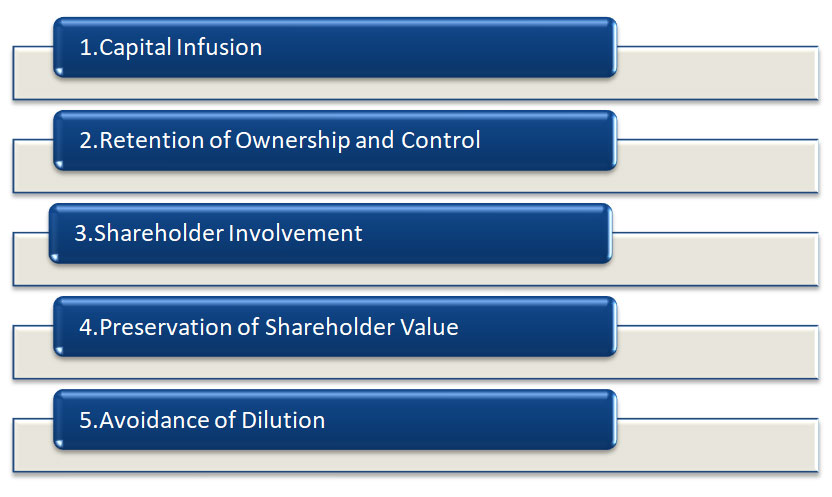

BENEFITS OF THE RIGHT ISSUE

1. Capital Infusion: A right issue allows a company to raise capital from its existing shareholders. This capital infusion can provide the company with the funds necessary to support its growth initiatives, finance acquisitions, reduce debt, or invest in research and development.

2. Retention of Ownership and Control: Participating in a right issue enables existing shareholders to maintain or increase their ownership stakes in the company. This helps to preserve their influence and control over the company's decision-making process.

3. Shareholder Involvement: Right issues provide existing shareholders with the opportunity to participate in the company's capital-raising efforts. By exercising their rights and purchasing additional shares, shareholders can demonstrate their commitment to the company and actively contribute to its growth.

4. Preservation of Shareholder Value: Right issues are often priced at a discount to the prevailing market price of the shares. This means that existing shareholders can acquire additional shares at a lower cost, potentially enhancing the value of their investment.

5. Avoidance of Dilution: By offering additional shares to existing shareholders, a right issue allows the company to raise capital without diluting the ownership stakes of its current shareholders. This is in contrast to issuing shares to external investors, which can result in a dilution of ownership.

GENERAL PROCESS FOR THE RIGHT ISSUE

1. Board Approval: The board of directors of the company must approve the issuance of right shares. This decision is usually made based on the company's capital requirements and financial situation.

2. Shareholder Approval: In some jurisdictions or as per the company's bylaws, shareholder approval may be required for the issuance of right shares. The company may need to convene a general meeting of shareholders to seek their approval.

3. Announcement: Once the board and/or shareholder approval is obtained, the company announces its intention to issue right shares. This announcement includes details such as the number of shares to be issued, the issue price, the record date (the date on which shareholders' eligibility is determined), and the subscription ratio.

4. Record Date: The Company determines a record date, which is the date on which the existing shareholders are identified for the purpose of issuing right shares. Shareholders recorded on this date are eligible to participate in the rights issue.

5. Information Memorandum: The Company prepares an information memorandum or offer document containing all the relevant details about the right shares. This document provides information about the purpose of the issue, the subscription price, the rights entitlement ratio, the timeline, and the procedure for subscribing to the right shares.

6. Subscription Period: The company specifies a subscription period during which existing shareholders can exercise their rights to subscribe to the additional shares. The subscription period typically ranges from a few weeks to a couple of months.

7. Rights Entitlement: Each existing shareholder is given a rights entitlement based on their existing shareholding. The rights entitlement ratio determines the number of right shares a shareholder is eligible to purchase for every share they currently hold.

8. Subscription Price: The Company determines the price at which the right shares will be offered to the existing shareholders. This price is usually lower than the prevailing market price to incentivize shareholders to exercise their rights.

9. Payment and Allotment: Shareholders interested in subscribing to the right shares make the necessary payment within the specified subscription period. Once the subscription period ends, the company reviews the applications and allocates the right shares to the subscribing shareholders. Allotment letters or statements are issued to shareholders who successfully subscribed to the right shares.

10. Listing and Trading: After the allotment of right shares, the company applies for the listing of the new shares on the stock exchange(s) where its shares are traded. Once listed, the right shares can be freely traded in the secondary market.

IMP NOTE:

1. for Private Company.

(a) PAS – 3 within 30 days from the allotment of the shares with the Registrar of Companies.

(b) MGT – 14 within 30 days of passing of the Board Resolution.

On June 5, 2015, the Ministry of Corporate Affairs issued a notification exempting private companies from filling form MGT-14

2. for Public Company.

(a) PAS – 3 within 30 days from the allotment of the shares with the Registrar of Companies.

(b) MGT – 14 within 30 days of passing of the Board Resolution.

FAQS

Q.1.What is a right issue?

Ans.A right issue, also known as a rights offering, is a process through which a company offers its existing shareholders the right to purchase additional shares at a predetermined price and within a specific time period.

Q.2.Why does a company undertake a right issue?

Ans.A Company may undertake a right issue to raise capital from its existing shareholders. The funds raised can be used for various purposes such as financing expansion plans, acquisitions, reducing debt, or funding research and development activities.

Q.3.What is the difference between a right issue and a bonus issue?

Ans.A right issue involves the sale of additional shares to existing shareholders at a predetermined price, while a bonus issue involves the issuance of free additional shares to existing shareholders in proportion to their existing holdings.

Q.4.Can new investors participate in a right issue?

Ans.Right issues are primarily offered to existing shareholders. However, in some cases, companies may allow new investors to participate if the existing shareholders do not fully exercise their rights.

Q.5.How is the subscription price determined?

Ans.The subscription price of the right issue is usually set at a discount to the prevailing market price of the company's shares. The specific discount is determined by the company based on various factors, including market conditions and the objective of the capital raise.

Q.6.How does a right issue work?

Ans.In a right issue, existing shareholders are given the opportunity to purchase additional shares in proportion to their existing holdings. The company determines the number of rights allotted to each shareholder, the subscription price, and the exercise period during which shareholders can exercise their rights.

Q.7.Can shareholders sell their rights in the market?

Ans.Yes, shareholders have the option to sell their rights in the market to other investors. This allows shareholders who do not wish to participate in the right issue to monetize their rights by selling them at a market-determined price.

Q.8.Can an application in the rights Issue be made using third party bank account?

Ans.Investors can make payment only using bank account held in their own name. Please note that Applications made with payment using third party bank accounts are liable to be rejected.

Q.9.Can a joint bank account be used to make applications on behalf of shareholders?

Ans. Joint bank account can be used by the applicant provided they are joint holders in the Bank account.

Q.10.Whether any persons who are not existing shareholders of the issuer company as on record date, can apply to the Rights Issue?

Ans. Persons who are not existing shareholders of the Company as on the Record Date can buy the Rights Entitlements through On Market Renunciation or Off Market renunciation and apply in the Rights Issue up to Rights Entitlements bought.

For any consultancy in the Right Issue matter||

Contact 7840071184/ 8505999955/ info@ngandassociates.com