Dissolve a partnership Farm

Partnerships are a common form of business structure that unite individuals with a shared vision and ambition to achieve success. While partnerships can thrive and accomplish great feats, there are instances when the inevitable decision to dissolve the partnership arises. Whether it's due to changes in personal goals, strategic disagreements, or economic challenges, the process of dissolving a partnership requires careful consideration and communication to ensure a smooth and amicable separation.

Dissolving a partnership is a significant decision that marks the end of a business relationship between two or more individuals. Whether the decision is due to irreconcilable differences, changing priorities, or the natural conclusion of a project, it is crucial to approach the process with care and clarity.

LEGAL PROVISIONS

Below are some general provisions that are commonly found in partnership laws:

1. Dissolution by Agreement (Section 32): Partnerships can be dissolved by mutual consent of all partners. If the partnership agreement specifies a fixed term, the dissolution may occur upon the expiry of that term. Alternatively, if the agreement is silent on the duration, partners may decide to dissolve the partnership at any time by mutual agreement.

2. Dissolution by Notice (Section 32): In the absence of a partnership agreement specifying the duration, any partner may give notice to other partners of their intention to dissolve the partnership. The partnership will be dissolved upon the expiration of the notice period mentioned in the notice, or if no period is specified, after a reasonable period.

3. Dissolution on the Occurrence of Certain Events (Section 32): Partnerships may be dissolved if certain events specified in the partnership agreement occur. These events could include the death, bankruptcy, incapacity, or withdrawal of a partner.

4. Dissolution due to Unlawful Activities (Section 40): A partnership can be dissolved if the business becomes illegal due to a change in law, or if the partnership engages in illegal activities, which would render the partnership void.

5. Dissolution by Court Order (Section 44): A court may order the dissolution of a partnership under certain circumstances, such as the incapacity of a partner, persistent breach of partnership agreement, misconduct by partners, or if it is just and equitable to dissolve the partnership.

6 Winding Up (Section 45): Upon dissolution, the partnership enters into the process of winding up its affairs. This involves the settlement of debts and liabilities, realization of assets, and distribution of remaining assets among the partners.

7. Rights of Partners during Winding Up (Section 46): During the winding-up process, partners are entitled to have the business accounts settled and to receive a share of the partnership assets after the debts and liabilities are discharged.

8. Notices to Registrar (Section 66): In many jurisdictions, partnerships are required to give notice of dissolution to the Registrar or relevant government authority within a specified period after the dissolution.

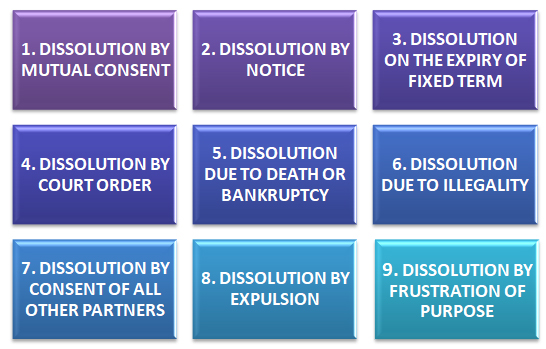

TYPES OF DISSOLUTION OF PARTNERSHIP

Here are the common types of dissolution of partnership:

1. Dissolution by Mutual Consent: This is the most common type of dissolution, where all partners agree to terminate the partnership. Partners voluntarily come to a consensus that the partnership is no longer viable or necessary, leading to its dissolution.

2. Dissolution by Notice: When there is no fixed term specified in the partnership agreement, any partner can give notice to the other partners of their intention to dissolve the partnership. The partnership will be dissolved after the expiration of the notice period mentioned in the notice, or if no period is specified, after a reasonable period.

3. Dissolution on the Expiry of Fixed Term: If the partnership agreement specifies a fixed term or a particular event upon which the partnership will end, the partnership will dissolve automatically at the end of that term or upon the occurrence of that event.

4. Dissolution by Court Order: A court may order the dissolution of a partnership under certain circumstances, such as:

a. Insanity or incapacity of a partner.

b. Persistent breach of the partnership agreement.

c. Misconduct of a partner, making it just and equitable to dissolve the partnership.

d. Other compelling reasons deemed fit by the court.

5. Dissolution due to Death or Bankruptcy: The death or bankruptcy of a partner can result in the automatic dissolution of the partnership, unless the partnership agreement contains provisions for the continuation of the partnership with the remaining partners.

6. Dissolution due to Illegality: If the business of the partnership becomes illegal due to a change in law or if the partnership engages in unlawful activities, the partnership may be dissolved.

7. Dissolution by Consent of All Other Partners: In case of a partnership at will, if one partner assigns their interest in the partnership without the unanimous consent of the other partners, the remaining partners may dissolve the partnership.

8. Dissolution by Expulsion: The partnership agreement may grant the power to expel a partner in certain circumstances, leading to the dissolution of the partnership or the withdrawal of the expelled partner.

9. Dissolution by Frustration of Purpose: If the primary purpose of the partnership becomes impossible to achieve due to unforeseen circumstances, the partnership may be dissolved.

SOME OF THE KEY ADVANTAGES OF DISSOLVING PARTNERSHIP

Dissolving a partnership can be a difficult decision, but it can also offer several advantages for the partners involved. Here are some of the advantages of dissolving a partnership:

1. Independence and Flexibility: Dissolving a partnership allows each partner to pursue their own individual goals and ventures independently. This newfound freedom provides partners with the flexibility to explore new opportunities and take their careers or businesses in different directions.

2. Resolution of Conflicts: If the partnership has been plagued by disagreements or conflicts among partners, dissolving the partnership can provide a resolution to these issues. It allows partners to part ways amicably and move on from any ongoing disputes.

3. Simplified Decision Making: With a partnership dissolved, partners no longer need to consult or seek consensus from others before making decisions. This streamlines decision-making processes and allows each partner to act swiftly in their best interest.

4. Liability Limitation: In some cases, a partnership's debts and obligations may become overwhelming. By dissolving the partnership, partners can limit their liability to the extent of their contributions, protecting personal assets from business-related liabilities.

5. Closure of Unsuccessful Ventures: If the partnership is facing financial difficulties or struggling to achieve its objectives, dissolving the partnership allows partners to close the venture gracefully. This can prevent further losses and provide an opportunity to reassess and start afresh.

6. Tax Advantages: Depending on the tax laws in the jurisdiction, dissolving a partnership may offer certain tax advantages. Partners may be able to offset losses, deduct business expenses, or restructure their businesses to optimize their tax positions.

7. New Opportunities: Dissolution can open doors to new opportunities and partnerships. Partners can leverage their experiences and skills from the previous partnership to forge new collaborations or start entirely different ventures that better align with their goals.

8. Personal Growth: Dissolving a partnership can be a learning experience for partners. It provides an opportunity for introspection and self-improvement, allowing individuals to identify their strengths and weaknesses and make better-informed decisions in the future.

DOCUMENTS REQUIRED FOR DISSOLVING THE PARTNERSHIP

Following are some common documents that are typically required for dissolving a partnership include:

1. Notice of Dissolution: A written notice of dissolution is usually required to inform all partners of the decision to dissolve the partnership. The notice should include the date of dissolution, the reasons for dissolution, and the agreed-upon procedures for winding down the partnership.

2. Dissolution Agreement: A dissolution agreement is a formal document that outlines the terms and conditions agreed upon by the partners for dissolving the partnership. It may cover the division of assets, settlement of liabilities, and the rights and responsibilities of each partner during the dissolution process.

3. Partnership Agreement: The original partnership agreement is essential to understand the agreed-upon procedures for dissolution, including any specific clauses related to winding down the partnership and distributing assets.

4. Resolutions of Partners: A written resolution, signed by all partners, confirming their mutual consent to dissolve the partnership is often required. This document serves as evidence that all partners are in agreement with the decision.

5. Certificate of Dissolution: In some jurisdictions, a certificate of dissolution must be obtained from the relevant government authority. This certificate confirms that the partnership has been formally dissolved and is no longer legally active.

6. Financial Statements and Records: Partnerships may need to provide financial statements and records, including income statements, balance sheets, and tax filings, as part of the dissolution process. These documents are used to settle debts, distribute assets, and address tax-related matters.

7. Notice to Creditors and Stakeholders: Partnerships may be required to notify creditors, clients, suppliers, and other stakeholders about the dissolution. These notices inform them of the partnership's closure and provide instructions on how to settle outstanding debts or claim payments.

8. Agreement to Distribute Assets: A written agreement among the partners stating the method and proportion of asset distribution is often required to ensure a fair and equitable division of partnership assets.

9. Consents and Releases: In some cases, partners may need to provide consents and releases, releasing each other from any further claims or liabilities related to the partnership after its dissolution.

10. Government Filings: Partnerships may be required to file specific forms or documents with the relevant government agency responsible for business registrations or partnerships to formalize the dissolution.

PROCESS FOR DISSOLVING THE PARTNERSHIP

Following is the general outline of the steps typically involved in dissolving a partnership:

1. Partner Meeting and Agreement: Initiate a meeting with all partners to discuss the decision to dissolve the partnership. All partners must agree to the dissolution. If the partnership agreement specifies a procedure for dissolution, follow those guidelines. If not, seek mutual consent from all partners.

2. Review Partnership Agreement: Review the partnership agreement to understand the provisions related to dissolution, including procedures for winding down the partnership and distributing assets. Adhere to the dissolution provisions outlined in the agreement.

3. Draft Dissolution Agreement: Create a dissolution agreement that outlines the terms and conditions agreed upon by all partners for the dissolution. This agreement should cover asset distribution, liability settlement, and the responsibilities of each partner during the winding-down process.

4. Notify Stakeholders: Inform employees, clients, suppliers, customers, and other stakeholders about the decision to dissolve the partnership. Provide a clear timeline for the winding-down process and address any concerns they may have.

5. Address Financial Obligations: Settle all debts and obligations of the partnership. This includes paying off outstanding loans, fulfilling contractual commitments, and clearing any debts owed to creditors.

6. Divide Partnership Assets: Determine the value of partnership assets and divide them among the partners according to their agreed-upon ownership percentages. Consider appointing an appraiser to assess the fair market value of assets.

7. File Legal Documents: Depending on the jurisdiction, partnerships may be required to file formal dissolution paperwork with the relevant government agencies. These filings notify the government of the partnership's termination and ensure compliance with legal requirements.

8. Complete Tax Obligations: Fulfill all tax obligations of the partnership. This may involve filing final tax returns and settling any outstanding taxes owed to tax authorities.

9. Winding-Up Operations: Gradually wind down the partnership's operations. Complete ongoing projects, fulfill contracts, and manage any remaining business matters before formally closing the partnership.

10. Execute Dissolution Agreement: Once all aspects of the dissolution process are completed, have all partners sign the dissolution agreement to confirm their agreement to dissolve the partnership.

11. Distribute Remaining Assets: After settling all debts and liabilities, distribute the remaining assets among the partners based on their ownership percentages as outlined in the dissolution agreement.

12. Close Bank Accounts and Cancel Licenses: Close the partnership's bank accounts and cancel any business licenses or permits associated with the partnership.

13. Notify Government Authorities: Notify relevant government authorities and other entities, such as licensing boards or professional associations, about the dissolution of the partnership.

14. Provide Employee Support: Assist employees during the transition, offering career counseling, references, and any necessary support during the winding-down process.

15. Inform Clients and Suppliers: Inform clients and suppliers about the dissolution and provide guidance on the next steps for working with the individual partners or finding alternative providers.

FAQS

Q.1. What documents are required for dissolving a partnership?

Ans: Notice of dissolution, dissolution agreement, partnership agreement, and financial records.

Q.2. Can a partnership be dissolved without mutual consent?

Ans: Only if specified in the partnership agreement or by court order in certain circumstances.

Q.3. What happens to assets and liabilities during dissolution?

Ans: Assets are divided among partners, and liabilities are settled from partnership assets.

Q.4. How long does it take to dissolve a partnership?

Ans: The duration varies depending on the complexity of assets, liabilities, and legal requirements.

Q.5. Are there any tax implications when dissolving a partnership?

Ans: Yes, partners may need to settle tax obligations and report gains or losses from asset distribution.

Q.6. Can we continue using the partnership name after dissolution?

Ans: No, the partnership name should be retired upon dissolution.

Q.7. What happens to employees during the dissolution process?

Ans: Employees may be provided assistance, counseling, and severance packages during the transition.

Q.8. Can we restart a new partnership after dissolution?

Ans: Yes, partners may choose to form a new partnership or explore other business arrangements.

Q.9. What are the common reasons for dissolving a partnership?

Ans: Financial struggles, strategic disagreements, retirement, or pursuing different opportunities.

Q.10. Do we need legal assistance to dissolve the partnership?

And: It is advisable to seek legal advice to ensure compliance with legal requirements.